Travel & Planning for New Destination Released. Free Shipping to Most Countries Around the World.

Free Shipping to Most Countries Around the World.

REFER TO THE FULL REPORT BELOW

Projections for 2025 indicate that China’s travel and tourism sector will contribute an unprecedented ¥13.7 trillion to national GDP – 10.3% higher than its pre‑COVID level and the largest contribution in the sector’s history. It will sustain over 83 million jobs, with 1.3 million new roles generated this year. Although overall employment remains about one million below the 2019 peak, the recovery path continues to strengthen, supported by renewed domestic travel enthusiasm, the revival of inbound tourism, and the digital evolution of the sector’s ecosystem. According to World Travel & Tourism Council (WTTC) forecasts, by 2035 China’s travel and tourism sector will become an even stronger economic driver, adding over ¥27 trillion to its GDP, or 14% of the total economy, while growing about twice as fast as overall economic output at 7%.

Nonetheless, the industry is witnessing a noticeable divergence in performance. Disparities between online platforms and offline enterprises, and between leading firms and smaller participants, have become more pronounced. In this context, offline sub‑markets have demonstrated stronger growth potential, while local destination governments and cultural administration authorities are playing increasingly important roles in shaping regulatory frameworks, guiding market order, and enhancing visitor experience. For instance, Huangshan’s partnership with Alipay has resulted in a full‑journey AI travel assistant that enhances convenience and personalization for both domestic and overseas tourists.

The rebound of international arrivals is deeply intertwined with the digital ecosystem and social media influence. The world’s perception of traveling in China has diversified, shifting from purely sightseeing to experience‑driven exploration embedded in local life – ranging from hot‑pot dining and night markets to shopping in trendy local art stores and exploring heritage neighborhoods.

Viral trends on global platforms – such as the meme “Off‑work Friday, fly to China”-illustrate a cultural zeitgeist where younger overseas travelers see China as an accessible, exciting, and safe destination for short breaks. Influencers, vloggers, and global celebrities – from IShowSpeed to Lisa from BLACKPINK, Tim Cook, and Ed Sheeran – have further amplified China’s global tourism image.

“Visa‑free expansion” has extended to include more countries across Asia and Europe, effectively enlarging China’s visa‑free travel network. This policy, combined with affordable air connectivity and in‑destination digital convenience, has catalyzed spontaneous travel among international tourists.

Since its launch in May 2024, Shanghai’s anonymous multi‑purpose prepaid card “Shanghai Pass,” designed for international visitors, has issued more than 86,800 cards, generating around 261,200 transactions to date. According to data from Trip.com, inbound travel bookings during the 2025 Spring Festival holiday surged by 203% year‑on‑year, with South Korea showing the most significant increase at 452%. Other major source markets include Malaysia, Singapore, Japan, the United States, Australia, Thailand, the United Kingdom, Russia, and Vietnam. Throughout 2024, a total of 610 million border crossings were recorded by China’s immigration authorities, up 43.9% compared with the previous year.

The visitor satisfaction indices for the first and second quarters of 2024 reached 81.7 and 82.9, respectively – both above historical averages and demonstrating a continual upward trend. Meanwhile, the number of foreign travelers purchasing train tickets at Shanghai Railway Station climbed to 1.85 million in 2024, representing a 250% increase compared with 2023 and averaging over 5,000 international passengers served per day.

Across China’s major cities, vivid cultural stories unfold through the experiences of inbound travelers – where sightseeing, consumption, and emotional connection blend into a single narrative of rediscovery. In Shanghai, long queues now form outside the Former Provisional Government Site of the Republic of Korea, where popularity on Trip.com’s heat index jumped by 370% within a single month. Meanwhile, in Chengdu, visitors from Singapore and Malaysia crowd the Chengdu Research Base of Giant Panda Breeding to see “Hua Hua”, often wearing panda accessories and sharing the experience on social media. These micro‑narratives exemplify how international travelers engage emotionally with Chinese cultural symbols.

Personal stories highlight the seamless integration of culture and digital convenience. Lee Wonjun, a visitor from Seoul, purchased White Rabbit candies and honey peach tea using Alipay upon arrival in Shanghai, commenting on the ease of cashless payments. Park Ji‑Eun and her friends from Seoul took a taxi directly to Haidilao Hotpot on Nanjing Road Pedestrian Street immediately after landing in Shanghai. “It always takes a long time to get a table at Haidilao in Seoul, so we decided to try the most authentic one here in China,” she explained. For visitors from Japan and South Korea, the visa‑free entry policy and short‑haul flights have made weekend trips increasingly effortless. Inoue Haruna, a Japanese student in Shanghai, shared that her visiting family toured the Bund, Yuyuan Garden, Xintiandi, and her university campus, admiring the city’s safety, accessibility, and friendliness – qualities that inspire them to return frequently. “My mother found Shanghai very convenient and safe,” she said. “She told me she would come to visit often whenever she has time.” Low‑cost carriers such as Spring Airlines have accordingly increased flight frequencies between Shanghai and Busan or Osaka in response to this surge in short‑haul travel.

Tang Yanhong, East China Regional Director of Coach, observed that starting from the second half of 2024, the number of international visitors shopping in Coach stores has continued to rise, particularly among travelers from Korea, Thailand, Singapore, and Malaysia. Although Coach has stores in these countries, some products that debut globally are available only in China. One limited‑edition design priced above ¥7,000 sold briskly, supported by tax rebates of roughly 9%. At Shanghai First Foodmall on Nanjing Road, iconic names like Wang Yutai tea have become cherished souvenirs. Labels such as Li‑Ning and Bosideng report a sharp rise in shoppers from Japan, Korea, Vietnam, Malaysia, and Singapore, attracted by “China Red” colorways and Spring Festival (Year of the Snake) collections.

Contemporary collectibles further symbolize the cultural crossover. POP MART’s LABUBU series remains a bestseller among Thai tourists, while MOLLY, SKULLPANDA, and CRYBABY continue to attract fans across markets. At Huawei’s flagship store on Nanjing Road, foreign visitors stop for selfies, product trials, or even car test drives. Davide, a traveler from Italy, remarked, “Huawei is well‑known in Italy; many of my friends use its phones.” Store staff report strong foreign interest in the Mate series and Pura series smartphones, including foldable models such as the dual‑screen and tri‑fold versions.

From Sichuan face‑changing performances to hand‑pulled noodle shows, many venues now employ multilingual staff who provide interactive cultural guidance, teaching visitors to join local viral dances such as “Subject 3” or celebratory songs, creating a distinctive atmosphere of cross‑cultural hospitality that blends commerce, culture, and community.

Parallel to the resurgence of inbound tourism, domestic travel in China is undergoing a transformation marked by new forms of expression. This shift is driven by younger generations who prefer personalized, immersive experiences over traditional sightseeing.

A nationwide survey of young travelers indicates that “slow travel” (55.3%) and ” self‑planned trips” (52.3%) are the most favored styles, reflecting a growing emphasis on flexibility, depth, and self‑discovery. Historical sites (57.2%) and natural landscapes (53.1%) remain the primary attractions, followed by iconic food experiences (45.1%) and intangible cultural heritage performances and folk festivals (42.1%). Other motivations include visiting film and television shooting locations (33.0%), attending concerts and theatrical performances (29.8%), exploring museums and science centers (21.8%), retracing the journeys of ancient scholars (17.5%), participating in sporting events (16.7%), and joining literature‑themed tours (16.4%).

Travel preferences have become increasingly diversified, encompassing theme‑based tourism (31.4%), group tours (26.8%), compact “check‑in” trips (24.2%), and exploratory journeys such as hiking or road trips (19.2%). Social influence serves as a powerful driver of these choices: 69.4% of young travelers are inspired by recommendations from peers, 62.3% rely on AI‑powered suggestions from online platforms, 59.7% draw ideas from social media searches, 34.1% seek inspiration from books and magazines, and 11.3% even choose destinations randomly using digital maps.

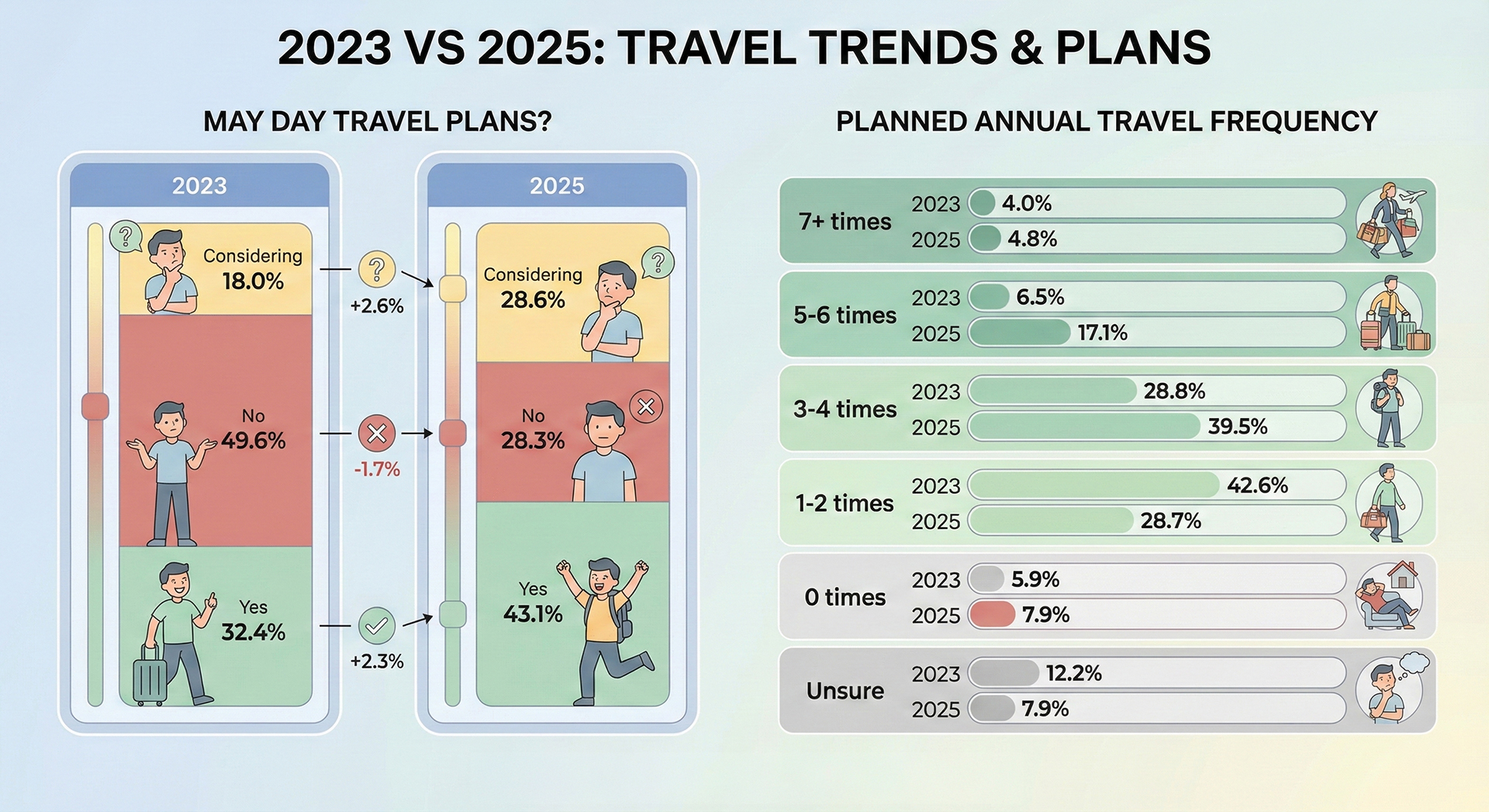

Survey data further reveal a notable increase in young people’s planned travel frequency in 2025. Whereas in previous years the majority intended to take only one or two trips (42.6%), this year the largest share plan to travel three to four times (39.5%). The proportions of respondents intending to travel five to six times – or even seven times or more – have both shown steady growth, signaling a rising enthusiasm for exploration and leisure mobility.

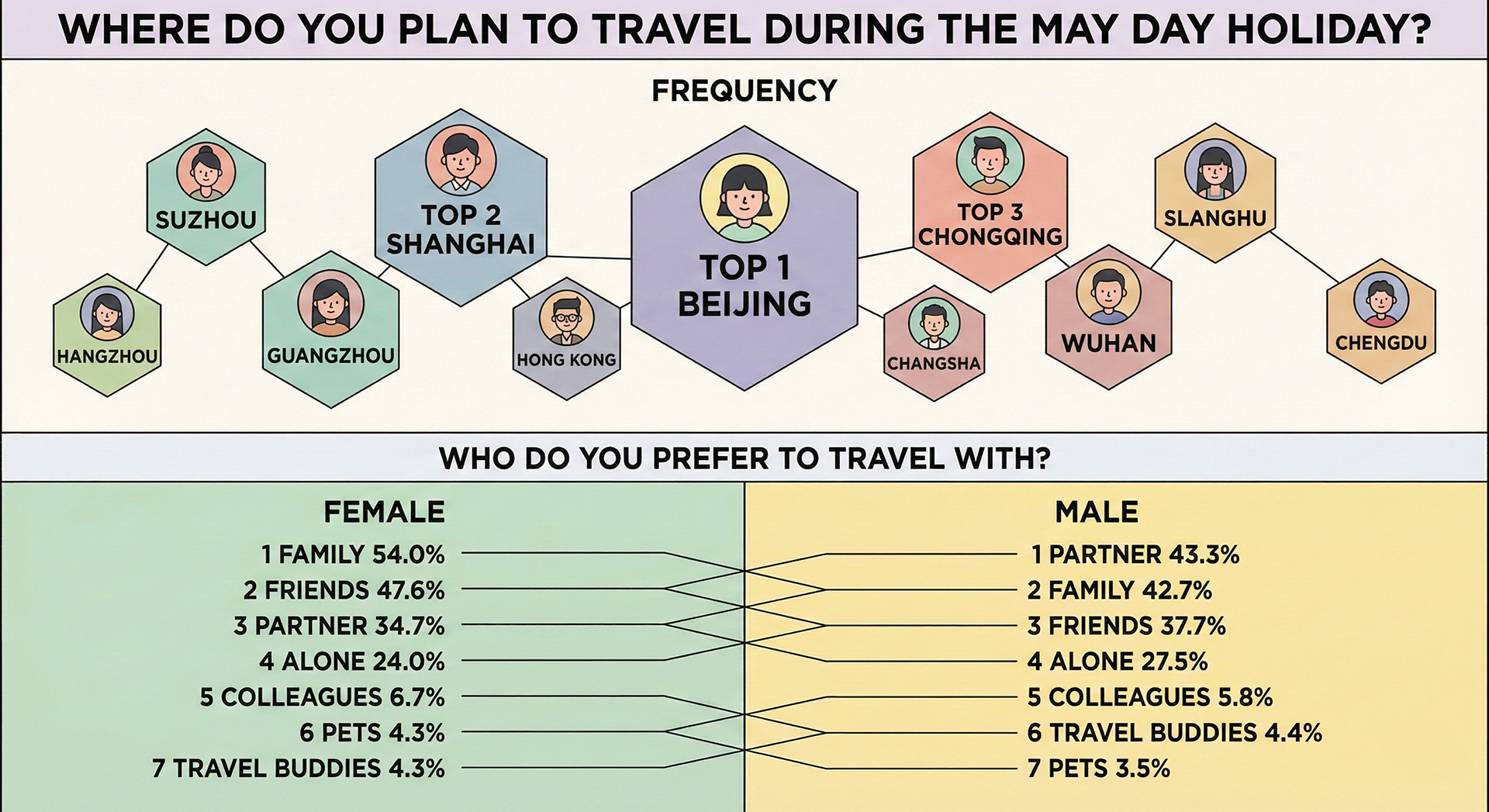

As for destinations, Beijing and Shanghai remain the top choices for national holidays such as the May Day break, followed by highly visible social‑media hotspots including Chongqing, Chengdu, and Wuhan. Those planning trips to Beijing or Shanghai are largely motivated by the cities’ distinctive skylines, cultural landmarks, and iconic attractions. Popular plans include watching the national flag‑raising ceremony in Tiananmen Square, visiting the Palace Museum, exploring the Oriental Pearl TV Tower, or spending a day at Shanghai Disneyland – activities that reflect an appetite for urban culture and metropolitan experiences. By contrast, respondents drawn to cities such as Chongqing, Chengdu, Wuhan, and Changsha are primarily seeking local specialties and vibrant nightlife scenes. Several interviewees even mentioned wanting to try Rongchang marinated goose – a dish that recently went viral on social media – illustrating how online trends increasingly shape culinary tourism.

When it comes to travel companions, most young people still prefer to travel with family or friends; however, preferences differ by gender. A higher proportion of women, compared with men, expressed a preference for family or friends – roughly ten percentage points higher in each case – while men ranked “romantic partner” as their top choice (43.3%), slightly ahead of “family members” (42.7%).

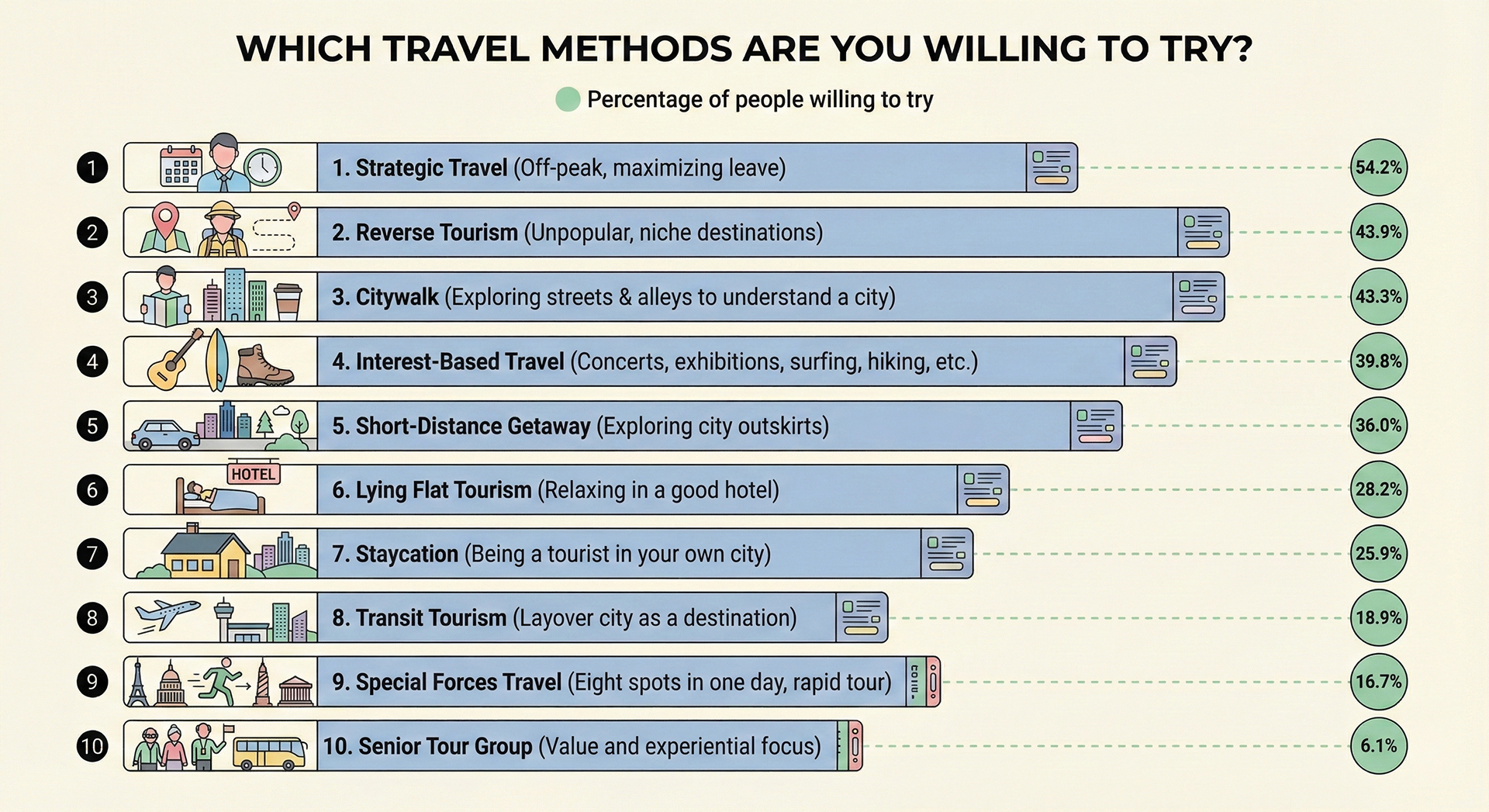

The concept of off‑peak travel has entered the mainstream, reflecting travelers’ growing preference for comfort and personal space. Over half of respondents (54.2%) indicated interest in “holiday optimization” through strategic leave planning – that is, extending official breaks by aligning public holidays with paid leave to create continuous vacations. More than 40% expressed plans to experiment with “reverse tourism,” choosing lesser‑known destinations to avoid heavy crowds. Online influencers have played a key role in popularizing these behaviors. On Xiaohongshu (RedNote), opinion leaders share detailed guides on maximizing holidays – for example, the viral tip “Take May 6–9 off to enjoy an 11‑day May Day vacation,” often accompanied by witty “leave‑request templates.” Such content normalizes the idea that rest, flexibility, and leisure planning are integral parts of modern travel culture.

As an essential component of tourism, the study of hotels has become a significant field within travel research. Overall, mid‑range and budget hotels remain the top choices among respondents. Ji Hotel emerged as the most popular hotel brand (27.8%), followed by Hanting (22.2%) and Atour (20.6%). Among high‑end luxury hotels, Hilton was the only brand to rank among the top ten.

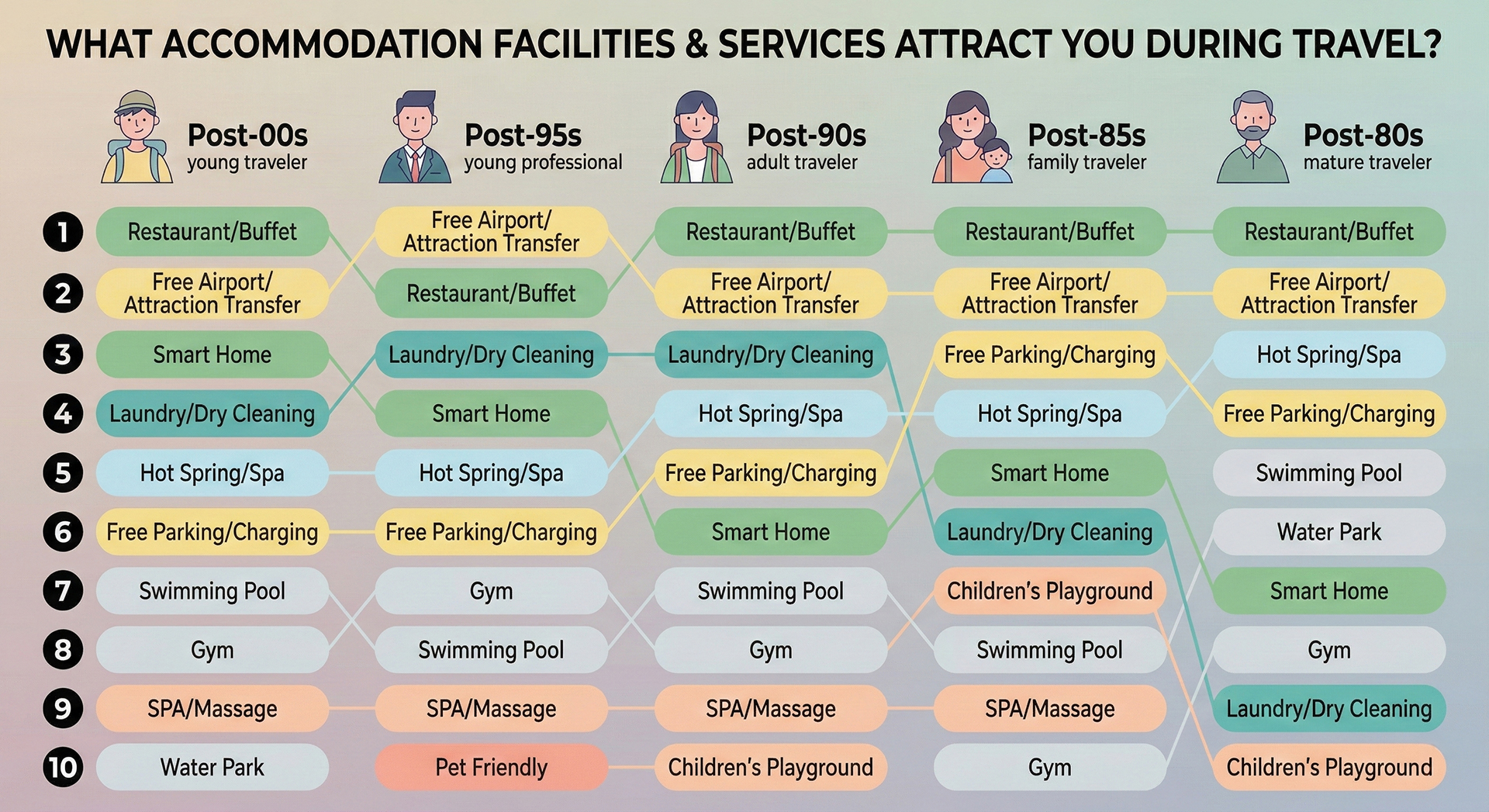

However, price does not necessarily determine travelers’ satisfaction or experience. Even a low‑cost hostel – priced at just a few dozen yuan per night-can offer young travelers the joy of exploration at minimal expense. Today’s hotels are no longer merely places to sleep, but have evolved into multifunctional leisure spaces that integrate rest, dining, entertainment, and social interaction. Among various amenities, restaurants and buffets, as well as complimentary airport or scenic‑spot transfers, are the most appealing across demographics. For younger generations – especially those born after 2000 and 1995 – laundry facilities are considered essential, and more than 30% of these respondents are attracted by smart‑home features. In contrast, travelers born in the 1980s show less interest in such amenities, preferring facilities such as water parks or fitness centers. Those born in the mid‑1980s and 1980s, who are more likely to travel by car or with family, place greater value on free parking and EV charging stations. Facilities like hot springs, swimming pools, and children’s play areas also have stronger appeal for this group than for younger cohorts.

Academy of Cultural & Tourism. (2025). New Insights: 2025 China Youth Travel Report Highlights Emerging Travel and Lifestyle Trends Among Young People. [online] Available at: http://www.sh-act.org/index.php?r=article/Content/index&content_id=2224 [Accessed 5 Dec. 2026].

Ctaweb.org.cn. (2025). Report Released | China’s Travel Market Demand Survey Report. [online] Available at: https://www.ctaweb.org.cn/en/xsjl/10141.html [Accessed 15 Dec. 2025].

Li, J., Luo, Q., Zheng, X., Zhang, C., Hu, W., Qi, T. and Su, H. (2025). DT Business Insight: 2025 Young People’s Travel Trends Report. [online] Fxbaogao.com. Available at: https://www.fxbaogao.com/view?id=4819408 [Accessed 15 Dec. 2025].

Liu, X. (2025). 2025 Report on the Development of China’s Travel Services Industry (Online Publication). [online] Ctaweb.org.cn. Available at: https://www.ctaweb.org.cn/xsjl/10022.html [Accessed 12 Dec. 2025].

Wang, M. (2025). Xinhua Finance Watch: What’s Driving the Boom in Inbound Tourism and What Is It Bringing? [online] News.cn. Available at: http://www.news.cn/fortune/20250122/75cf9bf847284950bb923515fa4a7495/c.html [Accessed 16 Dec. 2025].

Wang, Z., Wu, X., Liang, Z. and Zhang, X. (2025). 2025 China Youth Travel Insights Report: In the Age of AI, Over 90% of Young Respondents Still Value ‘Reading Widely and Traveling Far’. [online] Youth.cn. Available at: https://news.youth.cn/sh/202505/t20250520_16010365.htm [Accessed 14 Dec. 2025].

Wttc.org. (2025). China Surges Ahead: Travel & Tourism Sector Forecast to Hit a Record ¥13.7TN This Year. [online] Available at: https://wttc.org/news/china-surges-ahead-travel-and-tourism-sector-forecast-to-hit-a-record-13-7tn-this-year [Accessed 18 Dec. 2025].

We use cookies to optimize your experience, analyze usage, and personalize content. Your continued browsing indicates consent to our cookie usage and the sharing of site interaction data with our marketing and analytics partners.